We extend our sincerest gratitude to all participants of the “2024 Tax Compliance Virtual Symposium,” focusing on the European e-Invoicing Journey. Whether you were able to join us live or are planning to view the sessions at your leisure, we have gathered all the necessary resources to keep you well-informed and ahead in the tax compliance realm.

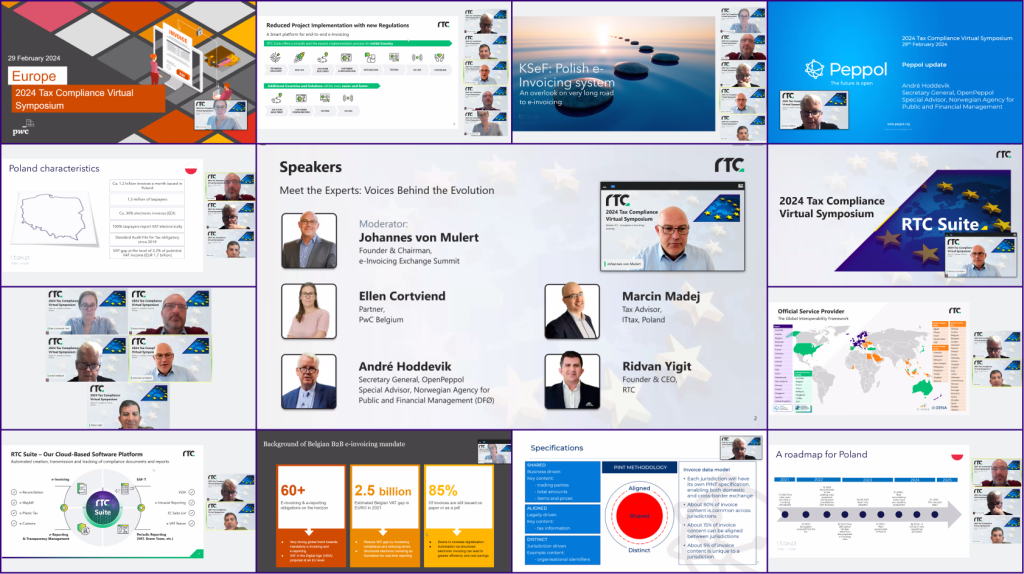

Our symposium kicked off with a comprehensive session on European tax compliance, led by industry experts such as Johannes von Mulert (E-Invoicing Exchange Summit), Ellen Cortvriend (PwC), Ridvan Yigit (RTC), André Hoddevik (OpenPeppol), and Marcin Madej (ITTax). The event was dedicated to uncovering the nuances of tax compliance across various regions, with a special focus on Europe, APAC, MENA, US, and Latin America.

Agenda Highlights Recap:

- Global and European Focus: An overview of the global e-Invoicing landscape, including updates and compliance strategies in France and Belgium.

- Country-Specific Insights: Detailed discussions on navigating e-Invoicing requirements in Poland and understanding the tax compliance achievements and challenges in Romania.

- Interactive Q&A Session: Participants engaged with our speakers to clarify doubts, gain deeper insights, and discuss practical solutions.

📹 Webinar Recording: Couldn’t attend the live sessions? Watch them on-demand to gain a comprehensive understanding of the tax compliance landscape.

📄 Presentation Deck: Recap the main points discussed during the sessions with our detailed slide decks.

🔍 Q&A Document: Expert answers to key questions from attendees, offering deeper insights.

Equip your business with expert insights. Access the on-demand sessions today to stay ahead in the evolving world of tax compliance.

Revisit these resources at any time on our RTC Insights blog, empowering yourself with the knowledge needed to navigate the complexities of tax regulations effectively.

Your feedback and questions are immensely valuable to us. For further information, additional materials, or inquiries, please feel free to reach out at contact@rtcsuite.com or leave a comment below.

With warm regards,

RTC Team