As the world shifts to a more digitalized landscape, tax authorities globally are rapidly transforming their traditional reporting systems into digital platforms. The Digital Reporting Requirements (DRR) have emerged as a response to this digital transformation, imposing a new set of challenges for multinational enterprises.

What are Digital Reporting Requirements (DRR)?

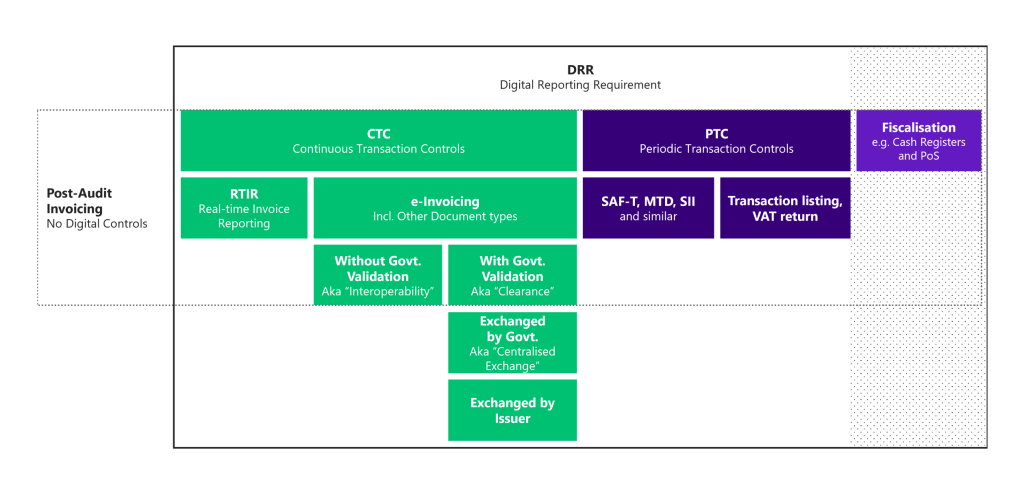

Refering to the mandate set by tax authorities across the world that requires businesses to submit their tax-related data in a digital format, Digital Reporting requirements (DRR) include rules like e-invoicing. While EU countries use these rules to increase tax earnings, the EU hasn’t set a common approach for all members. This makes e-Invoicing standards inconsistent across countries. These requirements aim to make tax collection and compliance more efficient, transparent, and reliable.

Why DRR Matters for Multinationals:

In the modern age of digitization, understanding and adapting to DRR is no longer optional for multinationals—it’s a necessity. Embracing these requirements can pave the way for streamlined operations, reduced errors, and enhanced compliance.

Unified Reporting:

With standardized digital formats, businesses can streamline their tax reporting processes across different jurisdictions.

Immediate Compliance Checks:

DRR allows tax authorities to instantly verify the authenticity and accuracy of the submitted data, reducing the turnaround time for approvals.

Data-Driven Insights:

With data being available in digital formats, authorities and businesses alike can glean actionable insights, enhancing strategic decision-making.

Benefits Posed by DRR:

Integration Issues

Existing traditional systems might struggle to adapt to the digital format requirements, leading to potential integration hurdles.

Data Security

Transferring sensitive financial data over digital platforms requires robust cybersecurity measures to prevent breaches.

Constant Evolution

The digital landscape is continually evolving. Keeping up with the latest DRR across multiple jurisdictions can be demanding.

Evolving Tax Regulations

Businesses are required to continuously monitor and adapt to updates from state authorities concerning digital reporting standards. Meeting these ever-changing guidelines and ensuring compliance becomes a considerable challenge.

Talk to Our Experts

Book a one-on-one session with our experienced team for personalized guidance on shaping your Tax Technology platform strategy.

e-Reporting

RTC Suite simplifies the process of generating and submitting electronic reports, ensuring efficient and accurate compliance with reporting requirements. Experience the ease and efficiency of E-reporting for streamlined compliance reporting.

SAF-T

By generating and sharing electronic files containing detailed transactional data, SAF-T (Standard Audit File for Tax) enables businesses to streamline tax reporting, ensuring transparency and compliance with tax regulations. Stay ahead in tax compliance with SAF-T integration.

e-Invoicing

Our e-Invoicing Solution simplifies invoicing with support for diverse standards, periodic and real-time reports, and compliance with VAT reporting. Streamline processes, improve efficiency, and access valuable insights while ensuring international compatibility. Our dedicated support team is ready to assist you.

ViDA

ViDA, short for VAT in Digital Age, offers organizations the ability to unlock valuable compliance insights through advanced analytics and reporting capabilities. Gain a visual and interactive exploration of your compliance data, enabling informed decision-making and proactive risk management.