What is SAP BTP?

SAP Business Technology Platform (SAP BTP) is a next-generation, open, and business-focused platform that helps organizations accelerate digital transformation and gain actionable insights. As a comprehensive solution, SAP BTP combines data management, analytics, application development, and intelligent technologies to create a unified foundation for innovation. Designed to enhance scalability and adaptability, SAP BTP integrates seamlessly with existing systems and operates across leading hyperscalers like Microsoft Azure, Amazon Web Services (AWS), Google Cloud, and Alibaba Cloud. With advanced capabilities such as artificial intelligence (AI), machine learning, and robotic process automation (RPA), businesses can streamline operations, improve decision-making, and achieve compliance with evolving regulations. SAP BTP is the cornerstone for companies aiming to harness the power of their data and drive sustainable growth in today’s dynamic digital landscape.

Part 1: Essential Insights for Tax Functions in Multinationals

What a tax function needs to know

This is the first of a series of articles about the SAP Business Technology Platform with a focus on an overview of relevant functionalities for a tax function of multinational groups.

SAP BTP – A strategic product for SAP

Starting in 2023, SAP has relaunched its SAP Corporate Strategy positioning the SAP Business Technology Platform (BTP), which replaced the SAP Cloud Platform at the heart of SAP’s product strategy as the unified, business-centric, open platform of SAP. The SAP BTP plays a key role in SAP’s mission to enable every enterprise to become an intelligent, sustainable enterprise[1]. Therefore, if a tax function of a Multinational looks for a future-proved application the BTP is definitely a great choice due to both the fact that the BTP will be used across the whole company and that state-of-the-art technology can be used.

SAP BTP – What is it about?

SAP BTP is an open, business-focused, multicloud platform that gives you everything you need to make confident decisions and drive continuous innovations. It’s the fastest way to turn data into business opportunity with analytics, intelligent technologies, data management, integration, and application development. SAP can provide all of this on top of the infrastructure of your choice[2].

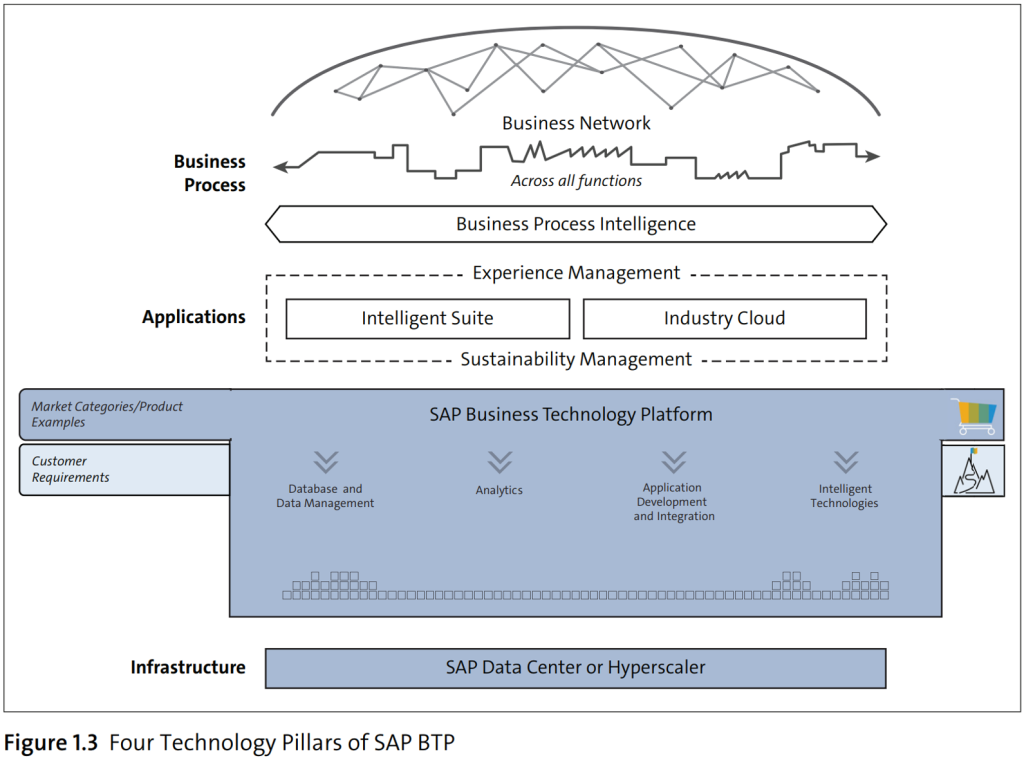

In other words, it’s a portfolio of SAP products, services, and solutions that are brought under one umbrella. It’s a collection of on-premise and cloud products and solutions grouped under four integrated technology pillars:

- database and data management,

- analytics,

- application development and integration, and

- intelligent technologies (see Figure 1.3)[3].

As you can see from Figure 1.3, the BTP supports all relevant dimensions of a tax technology transformation: Data (Management), Processes, Technology and People.

Let’s take a closer look at each pillar:

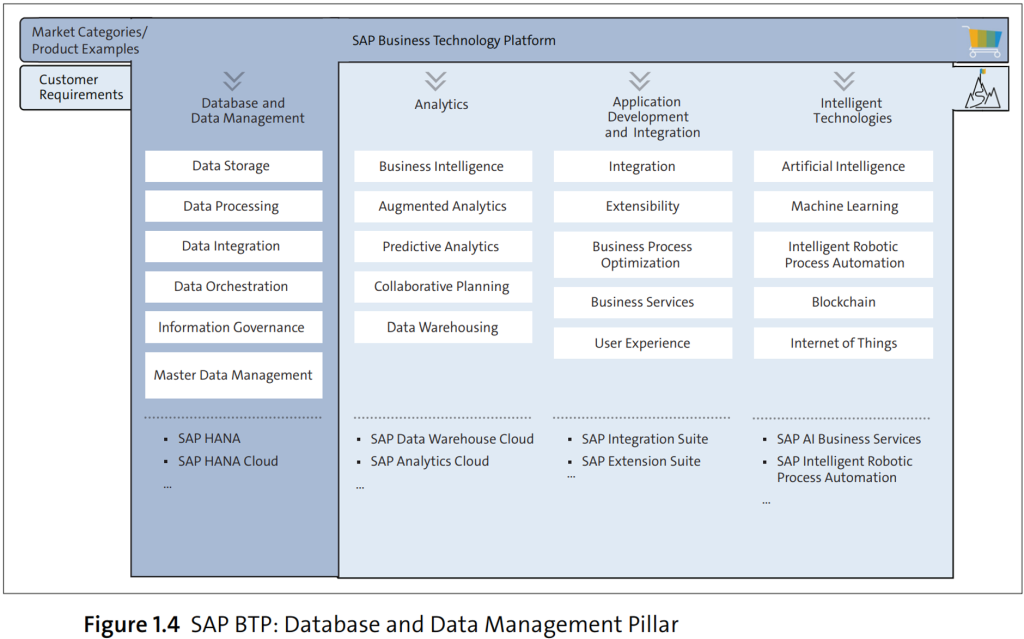

Database and data management: This pillar consists of everything you need to store, access, process, integrate, and interpret all relevant data in your (finance and tax) architecture. Figure 1.4[4] shows the key features and some products that are part of this pillar.

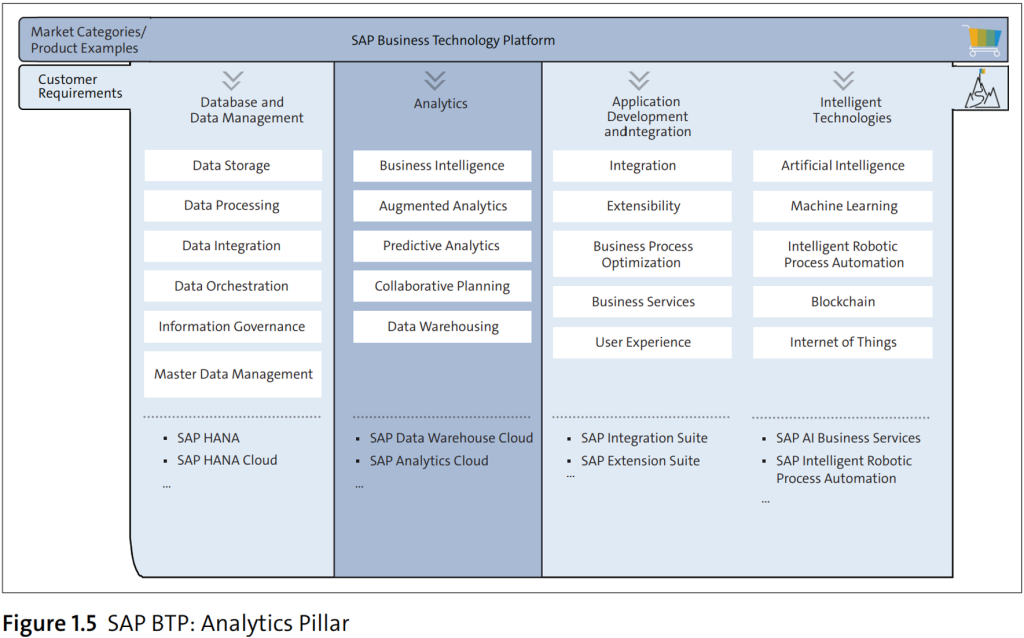

Analytics: Using the products under analytics, you can plan and forecast, make rapid decisions, and truly become insight-driven. Figure 1.5[5] shows the key features and some products that are part of this pillar.

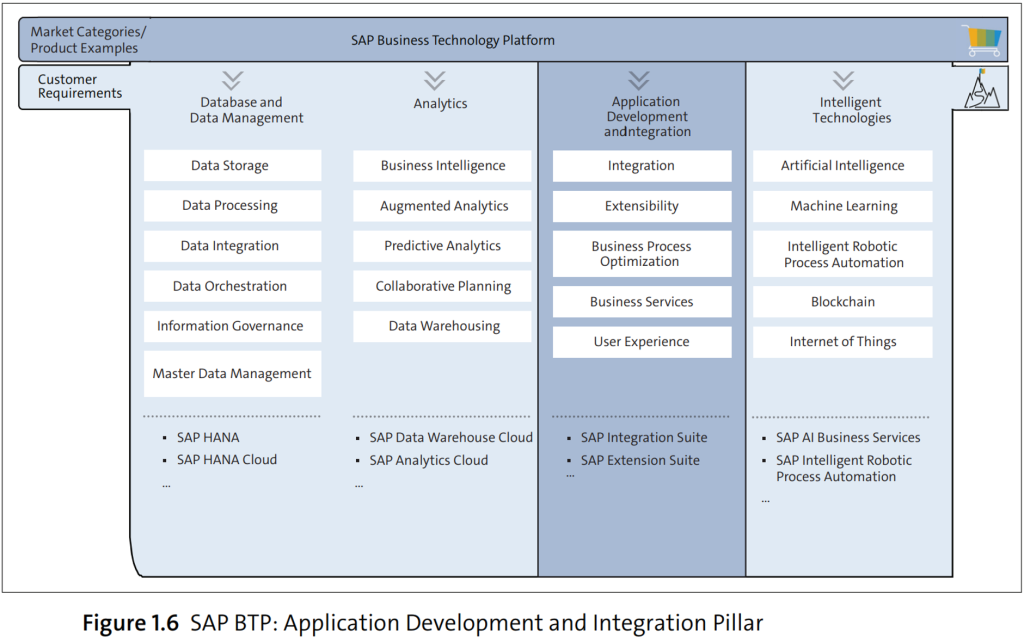

Application development and integration: SAP BTP is designed for business transformation and not just technology transformation or optimization. The application development and integration pillar gives a company and therefore also a tax function everything needed for agile process innovation, extension, and integration in the cloud and across hybrid scenarios. Figure 1.6[6] shows the key features and some products that are part of this pillar.

Intelligent technologies: AI, machine learning are getting embedded into everything—both simple and complex business and tax processes. Figure 1.7[7] shows the key features and some products that are part of this pillar. SAP solutions such as SAP Intelligent Robotic Process Automation (SAP Intelligent RPA) and machine learning let you automate the kind of complex repetitive decisions that make up a significant portion of business processes. This frees up your most valuable resource of all, people, who can now focus on more valuable tasks like tax planning or new tax requirements, like e-Reporting, ESG and Green taxes.

4 Pillars of SAP BTP

SAP Business Technology Platform (SAP BTP) is built on four key pillars that empower businesses to accelerate innovation, optimize operations, and achieve seamless integration:

- Database and Data Management

SAP BTP provides robust data storage, processing, and analytics capabilities. With technologies like SAP HANA and data integration tools, businesses can ensure real-time insights, efficient data handling, and improved decision-making.

- Analytics and Business Intelligence

The platform enables businesses to unlock actionable insights with advanced analytics tools. Through predictive analytics, dashboards, and reporting features, organizations can make data-driven decisions and enhance strategic planning.

- Application Development and Integration

SAP BTP supports the development and integration of applications across diverse environments. With low-code and pro-code tools, developers can create custom solutions tailored to specific business needs while ensuring seamless connectivity with existing systems.

- Intelligent Technologies

Harnessing cutting-edge technologies such as AI, machine learning, and the Internet of Things (IoT), SAP BTP drives automation and innovation. These tools enable businesses to enhance operational efficiency and deliver smarter, more personalized customer experiences.

By focusing on these four pillars, SAP BTP equips organizations with the tools and flexibility needed to thrive in today’s dynamic digital landscape.

Advantages of SAP BTP

SAP BTP provides a unified, enterprise-grade foundation across data, integration, and application development. Its open, multi-cloud architecture lets you deploy where your business operates, while built-in identity, encryption, audit logging, and Cloud ALM streamline security and compliance. Prebuilt connectors and event-driven patterns accelerate integration for SAP and non-SAP systems. Clean-core extensibility for S/4HANA reduces upgrade risk and improves total cost of ownership through reusable, governed services and consistent lifecycle management.

SAP BTP Use Cases

For tax and finance teams, SAP BTP enables end-to-end compliance scenarios such as e-Invoicing, e-Reporting, and SAF-T. Integration Suite manages secure transmission, while Data Intelligence and Datasphere prepare audit-ready datasets, and SAP Analytics Cloud delivers actionable insights. Teams can build lightweight extensions for validations, approvals, and dashboards without touching the ERP core. Beyond compliance, customers orchestrate document archiving, supplier onboarding, and event-driven automations with full traceability through Cloud ALM.

Conclusion

e-Reporting, SAF-T Reporting, Tax & Sustainability, Pillar Two: all this already existing and new tax requirements – ideally embedded in a tax control framework – need technology to be managed. To be able to remain compliant, tax functions within Multinationals need state-of-the art and future proved technology. SAP provides with the SAP BTP a comprehensive platform for the digital transformation and therefore also for the tax technology transformation in the coming years. As a Head of Tax talk to your colleagues in Finance, from the Business and especially with the IT guys about the SAP BTP. Very often the platform is already in place.

Part 2: Exploring SAP BTP Functionalities for Tax Functions in Multinationals

What services are available on the SAP BTP?

In the meantime there are a huge number of services available on the SAP BTP (see link https://discovery-center.cloud.sap/viewServices?regions=all&category=all).

Some highlights are:

- SAP Analytics Cloud, embedded edition: Used for analyzing data from source systems

- SAP Build Apps: Used for low-code/no-code application development

- SAP Business Application Studio: Used for developing applications

- SAP Cloud ALM: Used for managing implementations of cloud solutions

- SAP Conversational AI: Used for creating chatbots

- SAP Data Intelligence: Used for parsing data with AI and machine learning

- SAP Data Warehouse Cloud: Used for storing and accessing data from source systems

- SAP HANA Cloud: Used for in-memory database management and application development

- SAP Intelligent RPA: Used for automating repetitive, rule-based tasks with machine learning

As you can see there are definitely some services, respectively functionalities which are interesting from a tax function point of view in terms of data management, analytics, application development and Robotic Process Automation.

Is SAP BTP a Platform as a service (PaaS)?

The SAP Business Technology Platform (SAP BTP) is an open platform as a service (PaaS) offering that delivers – as mentioned – different kind of products and services. In case of PaaS, the SAP BTP is therefore delivered as a resource (hardware+software) to the customer.

In general, PaaS is a cloud computing model where a third-party provider delivers hardware and software tools to users over the internet. A PaaS provider hosts the hardware and software on its own infrastructure.

Is the SAP BTP a Software as a service (SaaS)?

In this case the SAP BTP is delivered as a cloud service to the customer, that is, an entire cloud-based application is provided that customers can access and use In general, Software as a service (or SaaS) is a way of delivering applications over the Internet—as a service. Instead of installing and maintaining software, you simply access it via the Internet, freeing yourself from complex software and hardware management.

Therefore, the SAP BTP can be used in both ways, as PaaS or as SaaS.

What is the relationship between the SAP BTP and (SAP) hyperscalers?

Due to the fact that the SAP Business Technology Platform (BTP) is an open platform based on a multi-cloud foundation enabling it to run on top of different hyperscalers like Microsoft Azure, Amazon WebServices (AWS), Google Cloud & Alibaba Cloud. The partnership with these hyperscalers has made it possible for SAP to scale and offer SAP BTP across various regions.

In general, SAP hyperscalers refers to public cloud providers that SAP uses as hosting partners for their cloud solutions and services.

How do the license models of the SAP BTP with RTC Suite work?

Do I need a separate SAP BTP license?

No. RTC’s SAP OEM partnership bundles the required SAP BTP components with your RTC Suite subscription.

What’s included in the annual subscription?

RTC Suite usage, cloud hosting, maintenance, and the transmission/archiving layer—everything you need to run periodic reports and real-time e-documents.

Is there a setup fee?

Yes, a one-time setup per company code and country. The scope depends on whether you’re enabling periodic reports or transaction-based processes.

How do ongoing costs scale?

By volume and geography—periodic e-reports scale by report counts and country; transaction e-documents scale by document volume and country.Can I add more company codes or products later?

Absolutely. The base subscription covers one company code and one product; you can extend as you expand.

SAP BTP FAQs

Is SAP BTP suitable for small businesses?

Yes, SAP BTP is designed to cater to businesses of all sizes, including small and medium enterprises (SMEs). Its scalable solutions and pay-as-you-go pricing model make it an ideal choice for small businesses looking to optimize processes, gain actionable insights, and enhance customer experiences without significant upfront investments.

What are the security features of SAP BTP?

SAP BTP incorporates advanced security measures, including data encryption, identity and access management, and compliance with global standards such as GDPR. These features ensure that your business data remains protected against cyber threats while maintaining transparency and integrity.

Is there a trial version of SAP BTP available?

Yes, SAP BTP offers a free trial version that allows businesses to explore its features and capabilities. The trial includes access to selected services, enabling users to test the platform’s functionalities before committing to a paid subscription.

Are there any limits to service usage in SAP BTP?

SAP BTP’s usage limits depend on the selected pricing plan and services. The free tier provides access to a limited set of resources, while paid plans offer more extensive capabilities. Businesses can customize their subscription based on their operational needs, ensuring optimal resource utilization.

If you have questions or if you need additional information, please feel free to contact: technology@rtcsuite.com

Ridvan Yigit, Founder & CEO, RTC

+44 7833 5373 88

Sources:

[1] How SAP Business Technology Platform (BTP) drives speed and value around the core | SAP Blogs, accessed 19 October 2023.

[2] , [3] , [4] , [5] , [6] , [7] Banda et al, SAP Business Technology Platform, Rheinwerk Publishing, 2023, p. 31, p. 33, p. 34, p. 35, p. 36, p. 36.