RTC extends our sincere thanks to everyone who joined the “CSE Countries: Implementing e-Invoicing & SAF-T Mandates” webinar covering Greece, Poland, Bulgaria, and Croatia.

Whether you attended live or plan to watch at your convenience, we’ve compiled the essential resources to help your teams stay ahead of the region’s evolving mandates.

In this session, Ahu Çağlayan (CXO, RTC — Moderator), Ksenija Cipel (Senior Tax Expert, TEB Business Consulting), and Hande Yagci (Regulatory Counsel, RTC) shared practical guidance on scope, timelines, phased rollouts, clearance/validation, and data reporting. From regulatory overviews to end-to-end transmission flows and audit-ready evidence, the webinar provides a concise roadmap for Finance, Tax, and IT stakeholders.

Agenda Highlights Recap

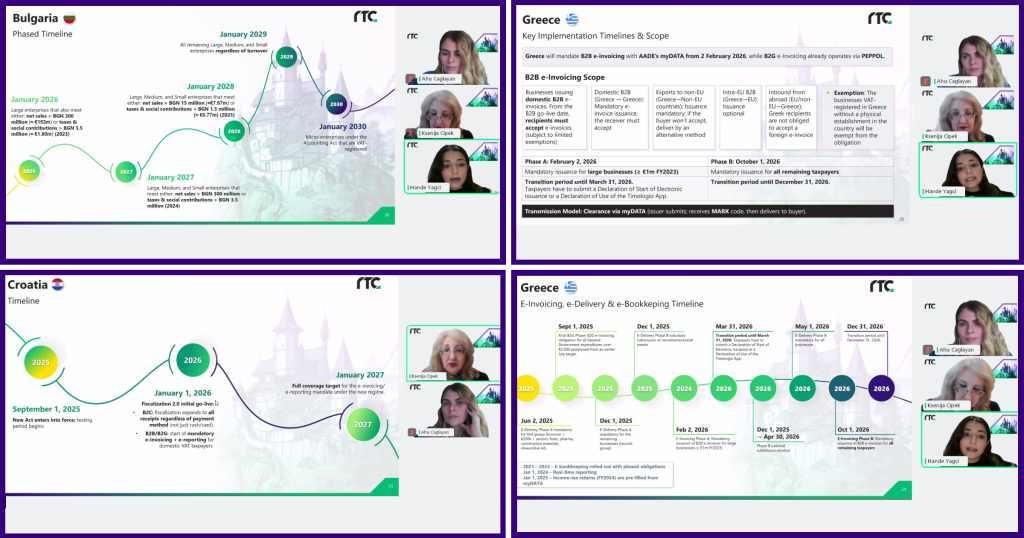

Greece – B2B e-Invoicing & myDATA

A clear overview of the framework, key business obligations, and how myDATA impacts invoice data submission, validations, and reconciliations.

Poland – KSeF + SAF-T/JPK_VAT

Latest KSeF updates and their implications for JPK_VAT/SAF-T; QR codes, real-time validation/clearance, contingency handling, and end-to-end data transmission.

Bulgaria – SAF-T

Scope and expected data domains, phased rollout considerations, and practical steps to generate, validate, and submit consistent files.

Croatia – e-Invoicing & Fiscalization 2.0 / e-Reporting

Mandate scope, deadlines, and compliance essentials; capturing, transforming, and transmitting data with monitoring and exception handling.

Watch the Recording & Access Resources

📹 Webinar Recording: Missed the live session? Access the on-demand recording to revisit country specifics, data flows, and implementation tips.

📄 Webinar Materials [Q&A Highlights & Presentation Deck]: Review expert answers to participant questions and download the slides for internal circulation.

Follow us on [LinkedIn] for the latest insights. You can explore these essential resources anytime on our RTC Insights Blog, equipping your business with the knowledge needed to navigate tax data complexities.

We appreciate your engagement and questions! If you need more details, additional materials, or have any inquiries, please reach out to us at contact@rtcsuite.com or share your thoughts in the comments section below.

With warm regards,

RTC Team