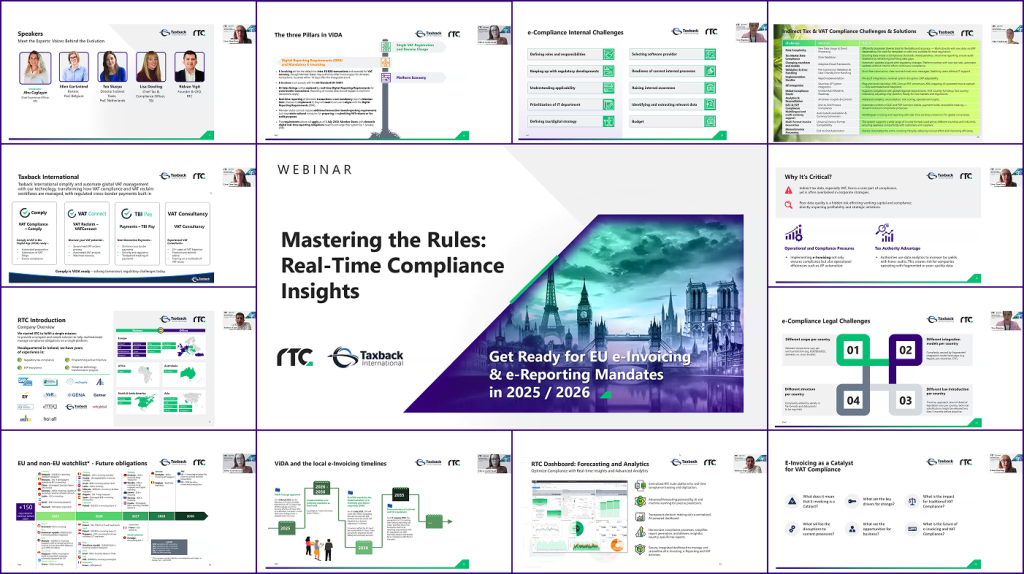

RTC extends our sincere thanks to everyone who joined us for the live webinar, “Mastering the Rules: Real-Time Compliance Insights,” hosted in collaboration with PwC and Taxback International.

As businesses across Europe prepare for the 2025/2026 rollout of mandatory e-Invoicing and e-Reporting, this session explored how organizations can take a proactive approach to real-time compliance, tax data strategy, and cross-border VAT readiness.

Whether you attended live or are tuning in now, we’ve made all the essential resources available to help you stay ahead of regulatory changes and optimize your tax technology roadmap.

Agenda Highlights Recap:

Real-Time Compliance & Strategic Tax Impact

Explore how regulatory momentum across the EU is driving the shift toward real-time compliance and reshaping tax functions.

2025/2026 Mandates Across the EU

Gain clarity on upcoming e-Invoicing and e-Reporting requirements, with expert guidance from PwC Belgium and PwC Netherlands.

Digital VAT Compliance Trends

Understand how e-Invoicing fosters standardization, enhances transparency, and supports jurisdictional alignment.

Leveraging Tax Data & System Integration

See how leading companies turn raw tax data into a strategic asset through integration, automation, and ownership clarity.

Technology as an Enabler

Discover emerging tools that support agility, automation, and future-ready tax transformation.

🎤 Meet Our Expert Speakers

• Ellen Cortvriend – Partner, PwC Belgium

• Tea Skarpa – Director Indirect Taxes, PwC Netherlands

• Lisa Dowling – Chief Tax & Compliance Officer, Taxback International

• Ridvan Yigit – Founder & CEO, RTC

Moderated by: Ahu Caglayan, CXO, RTC

Watch the Recording & Access Resources

📹 Webinar Recording: Missed it live? Watch the full session on demand.

📄 Presentation Deck: Download key takeaways and visuals from the webinar.

Staying informed on evolving compliance frameworks and digital tax transformation is crucial for future-ready businesses. Access our on-demand resources today and ensure your teams are equipped to lead in the new era of indirect tax.

Follow us on [LinkedIn] for the latest insights. You can explore these essential resources anytime on our RTC Insights Blog, equipping your business with the knowledge needed to navigate tax data complexities.

We appreciate your engagement and questions! If you need more details, additional materials, or have any inquiries, please reach out to us at contact@rtcsuite.com or share your thoughts in the comments section below.

With warm regards,

RTC Team