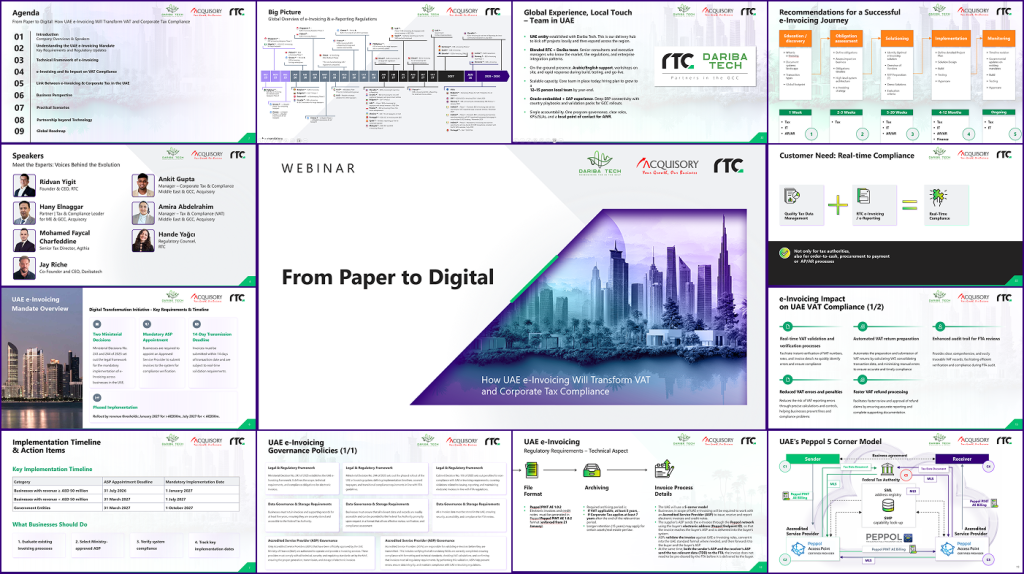

RTC extends our sincere thanks to everyone who joined us for the live webinar, “From Paper to Digital: How UAE E-Invoicing Will Transform VAT and Corporate Tax Compliance,” hosted in collaboration with Acquisory and DaribaTech.

As the UAE advances toward a fully digital tax ecosystem, this session focused on how e-Invoicing will reshape VAT and Corporate Tax compliance, system architecture, and operational readiness for businesses operating in the region.

Whether you attended the session live or are watching on demand, we’ve made all essential resources available to help you stay informed and prepared for upcoming regulatory changes.

Table of Contents

- Agenda Highlights Recap

- Meet Our Expert Speakers

- Watch the Recording & Access Resources

Agenda Highlights Recap

Understanding the UAE e-Invoicing Mandate

An overview of the UAE’s e-Invoicing direction, including regulatory objectives, scope, and alignment with global digital tax trends.

Technical Framework & System Architecture

Insights into the technical model of UAE e-Invoicing, integration considerations, and data exchange requirements.

Impact on VAT Compliance

A deep dive into how e-Invoicing will affect VAT reporting, data accuracy, audit readiness, and ongoing compliance processes.

Link Between e-Invoicing & Corporate Tax

Exploration of how invoice-level data will increasingly support Corporate Tax reporting and compliance obligations in the UAE.

System Readiness & Implementation Roadmap

Practical guidance on organizational readiness, implementation phases, and collaboration between tax, finance, and IT teams.

Case Studies & Practical Scenarios

Real-life examples and practical use cases highlighting challenges, best practices, and lessons learned.

🎤 Meet Our Expert Speakers

- Mohamed Faycal Charfeddine – Senior Tax Director, Agthia

- Ankit Gupta – Manager, Corporate Tax & Compliance, Middle East & GCC

- Amira Abdelrahim – Manager, Tax & Compliance (VAT), Middle East & GCC

- Jay Riche – Co-Founder & CEO, DaribaTech

- Hany Elnaggar – Partner | Tax & Compliance Leader for Middle East & GCC, Acquisory

- Ridvan Yigit – Founder & CEO, RTC

Moderated by:

Hande Yağcı – Regulatory Counsel, RTC

Watch the Recording & Access Resources

📹 Webinar Recording: Missed the live session? Access the on-demand recording to revisit country specifics, data flows, and implementation tips.

📄 Webinar Materials [Q&A Highlights & Presentation Deck]: Review expert answers to participant questions and download the slides for internal circulation.

Follow us on [LinkedIn] for the latest insights. You can explore these essential resources anytime on our RTC Insights Blog, equipping your business with the knowledge needed to navigate tax data complexities.

We appreciate your engagement and questions! If you need more details, additional materials, or have any inquiries, please reach out to us at contact@rtcsuite.com or share your thoughts in the comments section below.

With warm regards,

RTC Team