What a Tax Department[1] Should Know about SAP S/4HANA | Part 1

SAP S/4HANA is an intelligent Enterprise Resource Planning (ERP) application especially for large businesses. SAP S/4HANA was first introduced in February 2015 and SAP has set a deadline for its customers to migrate to SAP S/4HANA by 2027[2]. Therefore, also the tax department of a SAP customer has to develop a roadmap on how to deal with the migration to the new ERP system.

In the first introductory article, I would like to illustrate both the importance of the ERP system as the main source system (besides Microsoft Excel[3]) and the limitations of S/4HANA as an ERP application for the tax department. In the second article I would like to focus on the consequences of the differences between an On prem vs. Cloud version and the big challenges for the tax department in terms of implementation, migration and maintenance.

SAP S/4HANA as the Main Data Source

SAP S/4HANA is made up of a number of different modules, each of which covers a specific area of business operations. The most popular S/4HANA components include[4]:

- Financials

- Controlling

- Sales and Distribution

- Materials Management

- Production Planning

- Plant Maintenance

- Quality Management

- Project System

- Human Resources

These modules are structured according to core business functions and business processes and contains and manages inter alia all kind of

- Organisational data,

- Financial data, including accounts payable, accounts receivable,

- Various ledgers (IFRS, local GAAP, tax and in the future also Green) and

- Financial reporting, as well as

- Employee information,

- Customer information,

- Supply chain management information,

- Products related information, etc.

All these data is relevant and crucial for a tax department in terms of especially tax compliance and reporting in the fields of Indirect Taxes (e-Invoicing, e-Reporting, SAF-T Reporting) and also direct Taxes (e.g. Tax Reporting, Pillar Two and CbCR) as well as cross-tax type topics like Transfer Pricing, customs and nowadays also Tax@ESG.

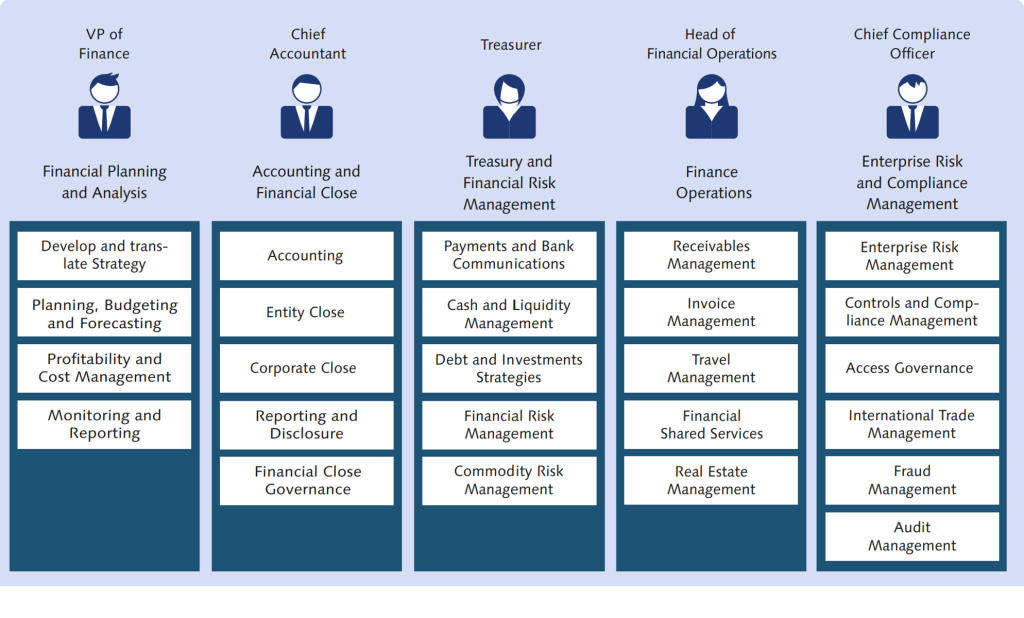

How comprehensive the task to manage data (and stakeholders) for the tax department can be, shows the image below as an example that consists of topics only related to finance[5].

Figure 1.3 Finance Value Map

It’s therefore crucial for the tax department not to be overlooked related to the tax requirements during an ERP implementation or migration.

Accurate and integrated tax data is critical especially for tax compliance and tax reporting. Failing to ensure data integration and accuracy during an ERP implementation and transformation can lead to significant compliance and reporting challenges and risks.

Due to permanent changes in tax regulations, failing to ensure that the ERP system can scale and adapt to these changes can lead to challenges in maintaining tax data integrity and compliance.

Therefore, ERP design decisions have huge implications on different tax types and processes.

Integrating tax requirements into the ERP system can especially:

- Improve control over tax data and reducing data gathering resources,

- Improve data quality (single source of truth),

- Enhance both effectiveness and efficiency of tax processes ending up with (major) cost savings,

- Improve the collaboration between the tax department and other stakeholders.

SAP S/4HANA is Not a Tax Calculation, Compliance and/or Reporting Solution

What a tax department needs to understand is that the scope of S/4HANA’s tax-related functionalities are (very) limited and vary in scope depending on the type of tax.

A tax department therefore has to deal with:

- A lack of a comprehensive treatment of tax requirements on a global scale. S/4HANA does not include a comprehensive treatment of tax requirements, leaving companies vulnerable to substantial risk related to e.g. tax determination, especially in the field of indirect taxes where less complex transactions can be handled in the system but more complex ones unfortunately not.

- A lack of a comprehensive treatment of tax requirements on a local level (localization challenges). Due to the fact that taxes is normally a local topic an ERP system is not capable of integrating all relevant tax requirements.

- Inadequate automation of tax-specific controls in the S/4HANA Core.

- A lack of E2E process logic. S/4HANA Core is not able to provide all E2E process steps from data gathering to submission of a report, here a tax return.

Differences Between SAP S/4HANA On-Premise and Cloud | Part 2

In this second article I would like to focus on the consequences of the differences between the SAP S/4HANA On-Premise vs. Cloud version and the big challenges for the tax department in terms of implementation, migration and maintenance.

SAP S/4HANA On-Premise refers to an application that is installed and hosted on the organisation’s own servers and data centres. SAP S/4HANA Cloud refers to an application that is a cloud-based solution where SAP manages the infrastructure and software updates.

SAP’s Cloud Strategy

CEO Christian Klein announced in a statement in July 2023 that SAP’s newest innovations would only be available with SAP S/4HANA Cloud, public edition or SAP S/4HANA Cloud, private edition delivered by GROW[6] with SAP or RISE with SAP[7]. They (= the newest innovations) will therefore not anymore be available in On-Premise deployments of SAP S/4HANA[8].

As you can imagine this aforementioned announcement was highly criticised by SAP customers. For example, “Cloud-first yes, cloud-only no!”[9] is the motto of the (very powerful) German-speaking SAP User Group e.V. (DSAG). Nevertheless, for a tax department it is crucial to understand that the future is in the cloud.

Differences between SAP S/4HANA On-Prem and SAP S/4HANA Cloud in Terms of Customization

In the first article I mentioned that an ERP system is not built to meet all global and local tax requirements, therefore flexibility and the possibility of customization is extremely important if a tax department wants to do as much as possible[10] in an ERP system. Customization in general allows an organisation, in our case the tax department, to tailor their systems to meet (specific tax compliance and reporting) needs.

In a S/4HANA On-Premise setup, tax departments have – from a pure technical perspective[11] – various customization options, allowing them to adapt the system to their precise tax processes and compliance requirements. On the other hand, SAP S/4HANA Cloud will provide only limited or no customization options. The reason is to maintain the stability of the cloud environment and to ensure seamless updates.

One out of many key topics for a tax department is the operationalisation of a tax control framework. In an On-Premise setup, tax functions have the ability and the flexibility to customise and integrate the system seamlessly with their established tax control framework. In contrast, SAP S/4HANA Cloud again may offer only limited or no integration options, potentially impacting the tax department’s ability to align with their desired control framework.

Another key topic is reporting (the submission of various tax reports (returns)), especially in terms of new Compliance and Reporting requirements as Real-/Near-Time or also SAF-T Reporting. In an On-Premise setup, a tax department can customise and optimise more related to the reporting functionalities needed. Again, in contrast, the SAP S/4HANA Cloud version may offer only limited or no flexibility in terms of E2E reporting and compliance functionalities.

Implementation and Migration Challenges

The main[12] implementation approaches are:

1. Greenfield Implementation

In a greenfield approach, organisations start with a clean sheet by implementing SAP S/4HANA from scratch. It is about redefining business processes, data models, and configurations to align with SAP S/4HANA’s best practices. While it offers a fresh start, it may require substantial time and resources for implementation and data migration.

2. Brownfield Implementation (System Conversion)

A brownfield implementation involves converting an existing SAP ERP system to SAP S/4HANA. It’s like an upgrade of your current system to the latest version due to the fact that it leverages existing configurations and data structures.

3. Bluefield Implementation (Selective Data Transition)

The bluefield approach combines elements of both greenfield and brownfield implementations. It allows organisations a selective transition of specific processes, data, or functions to SAP S/4HANA. This approach provides flexibility to redesign and optimise certain processes while retaining (other) critical aspects of the existing system.

Greenfield implementation is especially a big challenge for a tax department. For all implementation approaches, the truth is that It’s all about early Involvement! Tax departments should be integrally involved in the ERP implementation process from the right from the beginning to ensure that tax requirements are considered, addressed and implemented effectively. Collaboration with IT and Finance is crucial! The tax department needs to work closely with IT and finance teams to ensure that tax requirements are aligned with broader organisational goals and that tax technology aligns with IT initiatives.

The key task is defining the tax-specific requirements and to communicate them effectively within the project. Different stakeholders within the organisations may not fully understand tax processes and regulations. Ensuring active participation from tax professionals in cross-functional workshops may be challenging but needed to explain the need of specific functionalities and features and especially to align with the other stakeholders to end up with a solution that is supported by all (relevant) departments.

Maintenance Challenges

A very high-level overview in terms of maintenance. Related to S/4HANA On-Premise the maintenance of the application has to be done by the organisations who have to plan, test, and control all system upgrades, which happen yearly, giving them full control over the maintenance process. Related to S/4HANA Cloud, the cloud edition automatically upgrades the software quarterly without customer intervention, ensuring that businesses always have access to the latest features. There is then no control for the organisations over the maintenance process, they get informed about it.

Introduction into Tax@SAP S/4HANA. What a Tax Department Should Consider – General Remarks | Part 3

After the first two articles on an introduction to SAP S/4HANA – what a tax department should know, we would like to continue with a series of ten articles to discuss Tax@S/4HANA in more detail. The first article will discuss the challenges and opportunities for a tax department in relation to Tax@S4/HANA as a kind of introduction. The other nine articles will cover general setup (two articles), indirect taxes (two articles), direct taxes, green taxes, other taxes, tax transparency and S/4HANA and a tax control framework.

Tax@SAP S/4HANA? – What is it about?

Tax@SAP refers to all modules (including non-tax modules), explicit and “hidden” tax functionalities, but also (general) settings or features in SAP S/4HANA that can be used for tax purposes.

An example of such a module is Flexible Real Estate Management (RE-FX), which can provide useful information for property tax or real estate transfer tax topics. An example of an explicit tax functionality is tax determination (for indirect taxes or withholding taxes) in S/4HANA. An example of general settings is cost and activity allocation in SAP S/4HANA, which can be used (to a limited extent) for tax-related transfer pricing issues.

The main challenges for the tax department are:

- Acquire a basic knowledge of the different options,

- Assessing the specific benefits, and

- Implementing the appropriate functionality in coordination with other stakeholders in the business.

What are the Current Challenges of a Tax Department in General?

Many organisations are striving to become a data-driven, technology-enabled business. As a result, the tax function needs to think about how it can use data and technology to fulfil its role, both in terms of compliance and reporting requirements, and as a trusted business advisor that adds value to the business. Specifically, what kind of data is needed? What is the quality of the data? What does the data governance structure look like? What are the technology implications of the data? What technology is available? What is the impact on tax processes? What are the implications for colleagues (change management)? How do new regulatory requirements, such as e-Reporting, affect processes, data management, etc.?

The Current Challenges in the Light of Tax@SAP S/4HANA

Based on the general challenges of a tax department (see above), the following specific challenges arise for the tax department in the context of S/4HANA: What data do I find in SAP S/4HANA? What is the data quality of the data in S/4HANA? Example: The tax department manages a VAT group, but not all companies are recorded in SAP S/4HANA. How do I create the VAT return for the VAT group? In general: Thinking in terms of E2E process logic, how far can I go with the SAP S/4HANA standard, where are the limits both in terms of scope and functionality? How can or do I have to close gaps with other products (e.g. a reporting and compliance platform)? The tax department therefore needs to understand not only the data that is available in SAP S/4HANA, but also the functionalities that would, in principle, be available in SAP S/4HANA. We use the conjunctive because these functionalities then need to be implemented and maintained in day-to-day operations. This is because often not all the functionalities that are available in principle are used and implemented (and hopefully implemented in the right way).

What are the Current Opportunities of a Tax Department in General?

A challenge is always an opportunity. Becoming a data-driven organisation can be a great opportunity for a tax department in particular. A characteristic of the work of the tax department is that it is a very large consumer of data, but much less often a data owner, and therefore always has data management issues. Nevertheless, the tax department is accountable for the task and therefore for the outcome. There are also huge developments in terms of technology within the business. The focus is on using the cloud, and the first AI (machine learning) use cases are being implemented in the business. Transformation is everywhere in the business, whatever that means in concrete terms.

From a tax perspective, there is now an opportunity to implement a comprehensive tax data management. Current tax use cases such as e-reporting (real-time/near-time reporting) or new SAF-T regulations require a technology solution, while BEPS Pillar Two requires a data model that does not (yet) exist in this form. Data management is the basis for the further development of (core) tax processes and technology is the basis for the implementation of these processes. Active tax managers are now taking a slice of the (transformation) cake (budget) in order to be able to implement the necessary transformation of the tax department.

The Current Opportunities in the Light of Tax@SAP S/4HANA

As mentioned above, SAP S/4HANA offers numerous functionalities and features that can be (very) interesting from the perspective of a tax department. Particularly in the area of data management, it makes sense for the tax department to take a close look at the existing data and get an overview of the tax use cases for which the existing data can be used. In a second step, the tax department should then approach the responsible data owner and discuss data quality and data usage.

In the area of business functionalities, there are also some standard functionalities that can certainly be used, although experience shows that once the business model reaches a certain level of complexity, the SAP S/4HANA standard is not sufficient for most (and the most important) tax use cases from the tax department’s perspective, see e.g. tax determination or e-Invoicing, e-Reporting, SAF-T reporting or Transfer Pricing. However, the tax department seldom has to contribute to the cost of S/4HANA, so it is worthwhile to get involved.

Businesses are moving towards becoming data-driven organisations. The tax department must follow suit. An SAP S/4HANA transformation project offers a very interesting opportunity to tackle the challenging issue of tax data management. SAP S/4HANA provides a comprehensive data model that forms (at least) the basis for various tax use cases. A tax department should therefore take the opportunity to analyse the existing data and the standard functionalities of SAP S/4HANA in order to generate the greatest possible benefit for its daily work.

Introduction into Tax@SAP S/4HANA – What a Tax Department Should Consider – General Tax Set-Up | Part 4

In the second and third articles of our series on Tax@SAP S/4HANA, we talk about general issues that a tax department should be aware of on its S/4HANA journey (general tax set-up).

The second article focuses on the SAP Implementation approach: called SAP Activate, the International Roll-out template approach and SAP best practices and the SAP Model company.

All companies that use SAP ECC or R/3 as their ERP system will have to migrate to S/4HANA in the next few years . Since – from the tax department’s perspective – the ERP system is one of the most important, if not the most important source system of all, it is essential for the tax department to get involved in the transformation project.

Regardless of concrete tax use cases and specific tax functions in S/4HANA, there are general topics and functionalities that a tax department should know and familiarize itself with to get the most out of the new S/4HANA ERP-system.

SAP Implementation Approach: SAP Activate

SAP Activate is the implementation framework for the implementation of SAP S/4HANA. SAP Activate is a combination of Best Practices and Guided Configuration with the goal of providing an optimized agile approach for the implementation of SAP S/4HANA.

SAP Activate consists of four key phases for an SAP S/4HANA implementation project: Prepare, Explore, Realize and Deploy. Of course, the specific scenarios and procedures within an SAP S/4HANA project differ depending on the specific situation (in particular the technological and process-related framework conditions) in the company. Nevertheless, a tax department must understand the framework.

1. Phase: Preparation

In phase 1, the strategic starting position of the tax function (note: not (only) the tax department) is analysed and the strategic target position is defined. Implementation measures and the definition of specific project requirements and (tax) use cases for the SAP S/4HANA transformation (costs, risk and value creation) are defined.

2. Phase: Explore

This phase focuses on the conception of the individual (in our case the tax related) sub-requirements from the fields of data management, tax determination and calculation, analytics, process management and monitoring, reporting, and overall system administration, and handling.

3. Phase: Realise

In phase 3, suitable solutions are implemented to achieve the defined target priorities and fields within the SAP S/4HANA project for the tax function.

4. Phase: Deploy

In this phase, the tax department should monitor the effectiveness and sustainability of the implemented solutions, considering strategic, operational and resource requirements.

International Roll-Out Template Approach

An SAP S/4HANA project is often coupled with the global harmonisation and implementation of a standardised ERP system. As a rule, many entities (subsidiaries and branches) local and abroad are affected by the transition to SAP S/4HANA. The introduction of a centralised SAP S/4HANA system for all countries and all entities is a major challenge for both the company and its tax function. Time, costs, cultural differences, and the availability of expertise are key issues. The approach and methodology you choose can have a significant impact on the success of the project.

From the perspective of the tax function, it is therefore recommended to define a template approach as a blueprint for the standardisation of (at least the global) tax processes and the corresponding functional scope of your SAP S/4HANA system.

In a global tax template, all generally or global applicable specifications can be defined for each tax type and/or tax process across all countries. The legal requirements of the local companies extend the functional scope of the template to a local tax template.

SAP Best Practices and SAP Model Company

SAP Best Practices[13] are provided by SAP. This means that they are part of the SAP S/4HANA core product and are included in every product licence. SAP Best Practices for SAP S/4HANA are designed to accelerate and simplify the implementation of SAP S/4HANA. Preconfigured content for core business processes is provided for this purpose. All supported business processes are fully documented.

In contrast to SAP Best Practices, the SAP Model Company not only includes SAP S/4HANA functions, but also covers other SAP solutions. In addition, each SAP Model Company is tailored to a specific industry.

Introduction into Tax@SAP S/4HANA – What a Tax Department Should Consider – General Tax Set-Up | Part 5

In the second and third articles of our series on Tax@SAP S/4HANA, we talk about general issues that a tax department should be aware of on its S/4HANA journey (general tax set-up).

The third article focuses on the Tax requirements along the business processes and on a tax use case catalogue.

All companies that use SAP ECC or R/3 as their ERP system will have to migrate to S/4HANA in the next few years[14]. Since – from the tax department’s perspective – the ERP system is one of the most important, if not the most important source system of all, it is essential for the tax department to get involved in the transformation project.

Regardless of concrete tax use cases and specific tax functions in S/4HANA, there are general topics and functionalities that a tax department should know and familiarize itself with to get the most out of the new S/4HANA ERP-system.

Tax Requirements Along the Business Processes

Economic activities are reflected in the company’s business processes. A process represents a set of logically linked individual activities to achieve a specific business objective. This can be the processing of an order, the execution of a delivery or the preparation of annual financial statements. Modern ERP applications such as SAP S/4HANA map these business processes in the system.

This means that business processes play a central role in your SAP S/4HANA implementation. At the same time, there is hardly any economic activity or business process without tax implications. Clearly structured business processes are therefore not only essential from an operational point of view, but are also important for handling tax tasks, in particular for ensuring tax compliance (e.g. VAT reporting, e-Reporting, but also SAF-T reporting). This makes it all the more important to organise the process landscape before the start of the SAP S/4HANA project.

One way to do this is to analyse the business processes using end-to-end scenarios. End-to-end scenarios bundle business processes along the process organisation in the company.

The end-to-end scenarios often form the basis for an organisational structure that divides the SAP S/4HANA project into working groups.

From the perspective of the tax function, it is important to participate in the working groups that touch on tax issues right from the start in order to be able to communicate requirements at an early stage. In practice, the following end-to-end scenarios are frequently encountered:

- Hire-to-Retire (HR)

- Idea-to-Offering (Sales)

- Market-to-Order (Sales)

- Quote-to-Cash (Sales)

- Order-to-Cash (Sales)

- Plan-to-Produce (Production)

- Acquire-to-Retire (Production)

- Plan-to-Inventory (Production)

- Procure-to-Pay (Procurement)

- Forecast-to-Delivery (Finance)

- Record-to-Report (Finance)

The end-to-end scenarios shown above map the totality of business processes, e.g. according to operational functions in the company such as HR, sales, production, and finance, and are a common approach in practice for bundling business processes. However, different scenarios are possible, depending on the specifics of the industry. From the perspective of the tax function, the end-to-end scenarios and the underlying business processes form the link to the operational level and therefore they are the essence of a tax target operating model.

The major challenge for the tax department is to harmonise the horizontal E2E business process logic with a (more) vertical tax type logic. The main taxes in particular, such as VAT or corporation tax, have an impact on several business processes, meaning that the tax department has to deal with this business process logic in order to maximise the benefits of an S/4HANA transformation project.

Tax Use Cases Catalogue

As part of the project preparation, it can make sense to create a catalogue of requirements for the SAP S/4HANA project from the perspective of the tax function (and not only from a tax departments point of view). In our opinion, the better approach for the creation of the catalogue should be based on a top-down analysis with a focus on the relevant tax processes (based on tax types) and aligned with the business process logic (see above). The consideration of tax control framework requirements could also make sense.

Therefore, it makes sense to think about

- Tax Data Management including Metadata Management

- Indirect Tax requirements

- E-Reporting (Real-/Near-Time)

- Periodic Indirect Tax Reporting (Advance return, Annual return, etc.)

- Tax determination

- Direct Tax requirements

- Transfer Pricing requirements

- Transfer pricing transaction matrix

- Margin control transfer prices

- Tax Transparency requirements

- Other Reporting requirements

- e.g. SAF-T Reporting

- e.g. Withholding Taxes

- Green Taxes requirements

- Industry-specific tax requirements

- In general, document management, archiving and role concept

Summary

To summarise, S/4HANA is the most important, but by no means the only, data source for the tax department. With regard to data management, it can be said that a tax department should utilise as much data as possible from S/4HANA in as granular a form as possible and should make a particular effort with regard to data quality.

At its core, S/4HANA as an ERP system is not a calculation, compliance and/or reporting tool. A tax department must therefore consider a combination of S/4HANA and other solutions in the sense of a comprehensive tax architecture, ideally for a tax reporting platform.

Two key takeaways for a tax department are:

- Although SAP S/4HANA On-Premise offers more flexibility and customization, a broader set of functionalities, and more control over maintenance and upgrades compared to SAP S/4HANA Cloud, The future is in the cloud. Therefore, the tax department has to be aware of these trends and think about a broader approach in terms of architecture and especially about integration of S/4HANA with a tax platform.

- Integrating tax requirements into broader business processes – within a S/4HANA implementation project – needs an alignment with other departments (stakeholders) that have very often different goals and objectives.

[1] The tax department is a specific organisational unit or group accountable and responsible for tax. The tax function refers to all resources which are needed to manage taxes regardless whether they are part of the tax department or not, e.g. accounting resources.

[2] https://www.outsystems.com/blog/posts/sap-s4hana-migration, This deadline was initially announced in 2018, and it has been revised a couple of times since then due to slow adoption.

[3] Of course, it can be questioned whether MS Excel is actually a source system.

[4] https://ktern.com/article/sap-s-4hana-architecture-key-differences-benefits-and-components/

[5] SAP S/4HANA Finance – An introduction, 2nd. Edition, Rheinwerk Press, p. 37.

[6] GROWS is SAP’s new offering for new customers and midsize companies to get started quickly and easily with SAP S/4HANA

[7] RISE with SAP is a managed cloud service that helps organisations using on-premise ERP software, including SAP ECC and SAP S/4HANA, to migrate to the cloud

[8] https://sapinsider.org/blogs/saps-newest-innovations-will-be-cloud-only/

[9] https://dsag.de/presse/sap-should-reopen-the-door-to-innovation-for-all-customers/

[10] In my opinion, from an architecture point of view I would look into a more broader architecture approach and use the ERP system in a standard way.

[11] The tax department should always be aligned with other stakeholders, e.g. Finance, Accounting and of course the IT department.

[12] There exists also a hybrid approach: the implementation of different parts of SAP S/4HANA using various methods or a landscape transformation that involves a more comprehensive overhaul of an organisation’s IT landscape or even a system consolidation.

[13] Many SAP best practice elements are identical for SAP S/4HANA Cloud and on-premise. However, there is some cloud content that is not published for on-premise systems. Some SAP Best Practices are only relevant for the cloud, others only for on-premise systems.

[14] Depending on the maintenance contract somewhere between 2027-2030.