What is e-Invoicing in Germany?

e-Invoicing in Germany signifies a transformative approach to managing business transactions by replacing traditional paper-based invoicing with digital processes. This method offers significant advantages in terms of efficiency, accuracy, and compliance with regulatory frameworks, paving the way for a streamlined, modern financial landscape. As Germany continues to advance its digital agenda, e-Invoicing is becoming an essential component for businesses operating within its borders.

What is B2B e-Invoicing in Germany?

Business-to-Business (B2B) e-Invoicing in Germany involves the exchange of invoices between businesses electronically. This digital approach eliminates the need for physical paper trails, reducing environmental impact and cutting operational costs. Germany e-Invoicing B2B accelerates the invoicing process, enhances data security, and improves transaction accuracy by reducing human error. It also facilitates better compliance with tax regulations, as electronic records are easier to track and audit.

What is B2G e-Invoicing in Germany?

Business-to-Government (B2G) e-Invoicing is mandated for all governmental transactions in Germany. This requirement ensures that businesses providing goods or services to government entities submit their invoices electronically. The adoption of B2G e-Invoicing Germany is a part of Germany’s initiative to enhance administrative efficiency and foster transparency in public spending. It is also aimed at reducing delays in payments, thereby improving cash flow for companies that engage with government contracts.

What is B2C e-Invoicing in Germany?

Business-to-Consumer (B2C) e-Invoicing Germany is rapidly growing as consumers increasingly embrace digital solutions for financial transactions. B2C e-Invoicing enables businesses to send invoices directly to consumers’ digital devices, such as smartphones or computers, facilitating immediate access and quicker payment processes. This method offers consumers convenience and accessibility, allowing them to manage their invoices and payments efficiently in a digital format.

When Will e-Invoices in Germany Become Mandatory?

The transition towards mandatory Germany e-Invoicing is part of a broader European movement aimed at standardizing electronic invoicing to enhance efficiency across the single market. For B2B transactions, the mandatory requirements are set to be phased in, with large corporations leading the adoption. e-Invoicing will become mandatory in Germany starting from January 1, 2025, for domestic B2B transactions. This requirement will be extended to all companies by January 1, 2028.

Who is obliged to use e-Invoicing in Germany?

In the current phase, all suppliers and service providers involved in B2G transactions must use e-Invoicing. This requirement is expected to extend to the B2B sector, starting with large businesses and gradually including SMEs. The phased approach allows businesses of all sizes to prepare for the transition, ensuring they can meet the technical and regulatory requirements without disruption. From January 1, 2025, all businesses established in Germany are required to issue and receive e-Invoices for taxable B2B transactions that are not VAT exempt.

How to Generate e-Invoices in Germany?

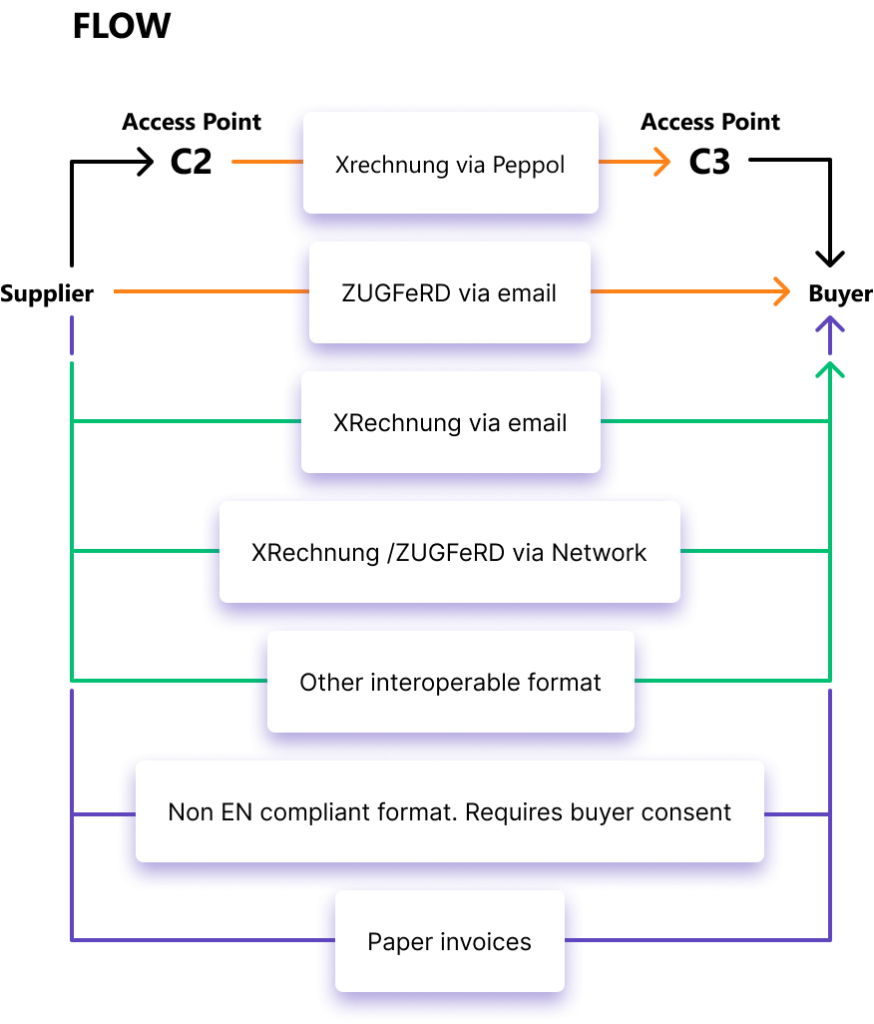

To generate e-Invoices in Germany, businesses must use e-Invoicing software that adheres to the XRechnung standard. This standard specifies the structure and semantics of electronic invoices to ensure uniformity and compliance with German and European regulations. The software used must be capable of creating, sending, receiving, and storing e-Invoices that fulfill all legal requirements, including data protection and privacy laws.

Germany e-Invoicing Requirements

German e-Invoicing requirements are stringent, designed to ensure that all electronic invoices contain necessary details for tax and regulatory compliance. These include accurate VAT identification numbers, clear descriptions of goods and services, and precise quantification and pricing. Invoices must also include date and time stamps and must be formatted in a way that supports automatic and electronic processing.

e-Invoicing in Germany Deadlines

The deadlines for adopting Germany e-Invoicing vary by sector. B2G e-Invoicing is already mandatory at the federal level, and similar requirements for regional and local government levels are expected to be implemented soon. The initial deadline for the mandate to receive structured e-Invoices is January 1, 2025. Aligned with Germany e-Invoicing timeline, the requirement to issue structured e-Invoices will start on January 1, 2028, for all businesses.

FAQs About e-Invoicing in Germany

What is the standard format for e-Invoices in Germany?

The standard format for e-Invoices in Germany is known as XRechnung. This format complies with the European Norm (EN) 16931, facilitating interoperability across EU countries. XRechnung is designed to be machine-readable, which simplifies the processing and integration of invoices into various accounting and ERP systems.

How does e-Invoicing benefit businesses in Germany?

e-Invoicing benefits German businesses by reducing costs associated with paper invoicing, such as printing and postage. It also speeds up the invoicing process, improves accuracy, and enhances cash flow management. Additionally, e-Invoicing simplifies compliance with tax and audit requirements by providing clear, traceable electronic records.

Can small businesses benefit from e-Invoicing in Germany?

Small businesses in Germany can greatly benefit from e-Invoicing. The transition to electronic invoicing reduces administrative burdens, lowers transaction costs, and provides faster payment processing. It also offers small businesses the opportunity to compete on equal footing with larger companies by improving their operational efficiencies.

Are there any exemptions to the e-Invoicing requirements in Germany?

Certain exemptions exist for small businesses and specific types of transactions that may not be conducive to electronic processing. However, these exemptions are limited and subject to change as the regulatory landscape evolves to fully embrace digital transactions.

How can businesses in Germany prepare for the e-Invoicing transition?

Businesses can prepare for the e-Invoicing transition by upgrading their accounting software, training staff on new systems, and engaging with professional services that can provide guidance and support throughout the implementation process. It is also advisable for businesses to participate in industry workshops and seminars to stay updated on the latest requirements and best practices.

What software solutions are available for e-Invoicing in Germany?

RTC Suite offers an advanced e-Invoicing solution tailored to meet the e-Invoicing requirements in Germany. It supports compliance with both the EN 16931 standard and the XRechnung format, ensuring that businesses can seamlessly issue and receive compliant invoices. With features such as automated data capture, real-time analytics, and secure cloud storage, RTC Suite helps businesses streamline their invoicing processes, reduce errors, and maintain compliance with German regulations.

Are there penalties for non-compliance with e-Invoicing regulations in Germany?

Yes, there are penalties for non-compliance with e-Invoicing regulations in Germany. These can include fines, penalties, and in some cases, exclusion from public contracts. Non-compliance with e-Invoicing mandates may lead to penalties up to EUR 5,000 per offence, and failing to issue e-Invoices may result in the inability to deduct input VAT. It is crucial for businesses to adhere to the mandated e-Invoicing practices to avoid these penalties and to ensure seamless business operations.