RTC extends our heartfelt thanks to everyone who participated in the “UAE e-Invoicing: A Corporate Perspective on the Mandate and Opportunities” webinar.

Whether you joined us live or are planning to watch the session at your convenience, we’ve compiled all the essential resources to help you stay informed on the UAE’s upcoming e-Invoicing mandate.

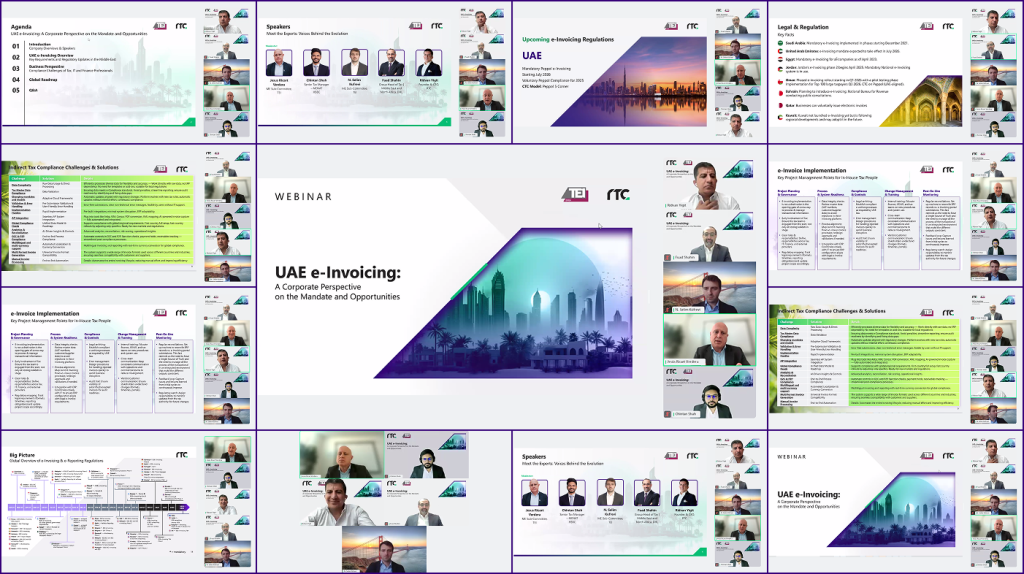

In this session, Jesús Ricart Verdera, Chintan Shah, Selim Kufrevi, Fuad Shahin, and Ridvan Yigit shared expert insights on the framework’s requirements, key opportunities, and practical steps businesses need to take in preparation for compliance. From the scope of the mandate to the technical and organizational aspects of integration, this webinar provided an in-depth view of the landscape ahead.

Agenda Highlights Recap

- Overview of the UAE E-Invoicing Mandate

A deep dive into the mandate’s scope, timeline, and phased rollout, with insights into its regional alignment with global e-Invoicing trends.

- Corporate Opportunities & Challenges

Exploring organizational requirements for tax, finance, and IT departments, as well as the challenges and opportunities for cross-border operations.

- Invoice Data, Reporting & Format Standards

Understanding the key technical requirements and addressing the challenges surrounding data handling and reporting.

- Immediate Steps for CFOs, Tax & IT Leaders

Guidance on actionable steps for business leaders to ensure compliance with the mandate.

Watch the Recording & Access Resources

📹 Webinar Recording: Missed the live session? Access the on-demand recording to catch up on all key takeaways and stay ahead of the compliance curve.

📄 Webinar Materials [Q&A Highlights & Presentation Deck]: Delve into our Q&A highlights to get additional insights from the experts and revisit the session’s key topics through the detailed presentation slides.

Follow us on [LinkedIn] for the latest insights. You can explore these essential resources anytime on our RTC Insights Blog, equipping your business with the knowledge needed to navigate tax data complexities.

We appreciate your engagement and questions! If you need more details, additional materials, or have any inquiries, please reach out to us at contact@rtcsuite.com or share your thoughts in the comments section below.

With warm regards,

RTC Team